For small business owners, the pulse of financial health lies in streamlined invoicing processes. But the challenge? Finding the perfect invoicing software amidst a sea of options. To resolve these issues for your business, we’ve navigated the waves and compiled the ultimate guide to the top 10 invoicing software solutions for your business in 2024.

In this journey you’ll discover 10 best invoicing software for small business that’ll transform your invoicing woes into a smooth, seamless operation, fueling your growth and success! So, let’s explore what is the best invoicing software for small business.

Criterias for Selection of the Best Invoicing Software for Small Business

Choosing the easy invoicing software for small business involves a careful evaluation process based on several key factors:

1. Features and Functionalities

- Invoicing Capabilities: Reviewing the core invoicing features such as creating, sending, and tracking invoices.

- Customization Options: Assessing the ability to customize templates, add logos, and personalize invoices.

- Automation and Reminders: Checking for automation features like recurring billing and payment reminders.

- Expense Tracking: Ability to record and manage expenses directly within the software.

2. User-Friendliness

- Ease of Use: Evaluating the software’s intuitiveness in navigating through features and functionalities.

- Accessibility: Assessing the software’s compatibility across devices (desktop, mobile, tablet).

- Learning Curve: Considering how quickly users can adapt and utilize the software effectively.

3. Pricing and Affordability

- Subscription Tiers: Reviewing different pricing plans (free, tiered, or subscription-based).

- Cost-Effectiveness: Analyzing the value offered in relation to the pricing structure.

- Scalability: Understanding how pricing might change as the business grows.

4. Integration and Compatibility

- Third-Party Integrations: Checking compatibility with other tools and software the business uses (e.g., accounting software, CRM systems).

- API and Add-Ons: Assessing the availability and functionality of APIs or add-ons for enhanced capabilities.

- Platform Compatibility: Ensuring compatibility with various operating systems and devices.

5. Customer Support and Resources

- Support Channels: Evaluating the availability and responsiveness of customer support (live chat, email, phone).

- Documentation and Training: Availability of guides, tutorials, and training resources for users.

- Community and User Forums: Access to a user community for discussions, troubleshooting, and sharing best practices.

6. Security and Compliance

- Data Encryption: Ensuring data security through encryption and secure transmission of sensitive information.

- Compliance Standards: Checking adherence to industry standards and regulations (GDPR, PCI-DSS, etc.).

- Backup and Recovery: Assessing backup protocols to prevent data loss in case of system failures.

7. User Reviews and Recommendations

- User Feedback: Analyzing user reviews, testimonials, and ratings across various platforms.

- Recommendations: Considering recommendations from industry experts or influencers.

8. Update Frequency and Future Development

- Update Frequency: Evaluating how frequently the software receives updates and improvements.

- Roadmap and Innovation: Understanding the company’s vision for future enhancements and features.

Businesses can effectively assess and select top invoicing software for small businesses that best aligns with their unique needs, budget, and growth aspirations by considering these comprehensive criteria. This holistic evaluation ensures a well-informed decision in choosing the right tool to streamline invoicing processes and drive business success.

#1 HubSpot Invoicing Software

HubSpot, known for its comprehensive suite of marketing, sales, and customer service tools, extends its functionality to include invoicing capabilities. It is one of the best and free invoicing software for small businesses. Designed to streamline the billing process for small businesses, HubSpot’s invoicing software integrates seamlessly with its CRM platform, allowing users to manage clients, deals, and invoices all in one place.

Key Features

- Invoice Creation and Customization: You can generate professional invoices quickly, personalize them with business logos and brand colors, and customize templates to reflect their company’s identity.

- Integration with CRM: Integration with HubSpot’s CRM enables easy access to client information, allowing for faster invoicing and improved accuracy in billing.

- Automated Payment Reminders: You can set up automated reminders for pending payments, reducing the need for manual follow-ups and improving cash flow management.

- Payment Tracking and Management: The software allows users to track payment statuses in real-time, providing insights into outstanding invoices and facilitating better financial planning.

- Recurring Billing: Simplifies recurring billing processes by automating the creation and sending of invoices for regular services or subscriptions.

- Payment Options and Processing: HubSpot supports multiple payment gateways, giving clients flexibility in payment methods and providing secure payment processing.

- Reporting and Analytics: Offers reporting tools to track invoice performance, monitor payment trends, and gain insights into financial metrics.

- Ease of Use: HubSpot’s user-friendly interface makes it easy for beginners to navigate and utilize the invoicing features without extensive training.

Pricing

HubSpot’s Invoicing software is part of its CRM platform, which includes a range of functionalities beyond just invoicing. The pricing for HubSpot CRM starts with a free plan, with limitations on features, and scales up with additional functionalities and advanced tools in paid plans.

Integration

HubSpot integrates with various third-party apps and tools, allowing users to connect their invoicing process with other business operations seamlessly.

User Feedback

If you’re looking for the best invoicing software for small business free then it will be a great option for you. HubSpot receives praise for its intuitive interface, seamless integration with the CRM, and its ability to streamline invoicing within the larger business ecosystem. However, some users might find the pricing for advanced features to be on the higher side for smaller businesses.

#2 Square Invoices

Square Invoices is a user-friendly invoicing tool designed specifically for small businesses and freelancers. It operates as part of Square’s ecosystem, integrating seamlessly with Square’s other services like payment processing and point-of-sale systems.

Key Features

- Customizable Invoices: Allows users to create professional-looking invoices tailored to their brand with customizable templates, logos, and colors.

- Easy Invoice Creation: Users can quickly generate invoices, add items/services, set due dates, and manage multiple invoices simultaneously.

- Automated Reminders and Recurring Invoices: Facilitates automatic reminders for overdue payments, reducing the need for manual follow-ups. Additionally, supports recurring invoices for subscription-based services.

- Payment Options and Processing: Seamlessly integrates with Square’s payment processing, allowing clients to pay invoices online securely through various methods like credit/debit cards or ACH bank transfers.

- Invoice Tracking and Status Updates: Provides real-time updates on invoice statuses, enabling users to track payments and monitor outstanding invoices.

- Mobile Accessibility: Square’s mobile app enables users to create, send, and manage invoices on the go, enhancing accessibility and convenience.

- Reporting and Insights: Offers reporting tools to analyze invoice and payment data, helping users gain insights into their financial performance.

Pricing

Square Invoices offers a simple and transparent pricing structure. Users are charged a 2.9% + 30¢ fee per invoice paid online. There are no monthly fees or setup costs, making it an attractive option for businesses sending occasional invoices.

Integration

Square Invoices seamlessly integrates with other Square services like Square Point of Sale and Square Payments, providing a comprehensive business solution.

User Feedback

You can appreciate Square Invoices for its simplicity, ease of use, and seamless integration with Square’s payment system. The transparent pricing model without monthly fees is also a significant advantage. However, some users may find the lack of advanced features compared to other invoicing tools a limitation.

#3 FreshBooks

FreshBooks is a popular cloud-based accounting software designed primarily for small businesses, freelancers, and self-employed professionals. It’s revered for its user-friendly interface and robust features that streamline invoicing, expense tracking, time management, and accounting tasks.

Key Features

- Invoicing Capabilities: Offers customizable invoice templates to reflect the brand identity. Allows for automatic recurring invoices and accepts various online payment options.

- Expense Tracking and Management: Enables users to track expenses by capturing receipts, categorizing expenses, and linking them directly to client projects or invoices.

- Time Tracking and Project Management: Includes time tracking tools that help track billable hours and expenses associated with specific projects or clients.

- Estimates and Proposals: Allows users to create estimates and proposals easily, which can be converted into invoices seamlessly.

- Client Portal: Provides a dedicated client portal where clients can view and pay invoices, track project progress, and communicate with the business.

- Financial Reporting: Generates reports on profit and loss, expenses, invoice details, and more, offering valuable insights into business finances.

- Mobile Accessibility: FreshBooks mobile app enables users to manage invoicing, expenses, and client communications on the go.

- Integration with Third-Party Apps: Offers integration with various business apps and services, enhancing its functionality and flexibility.

Pricing

FreshBooks offers multiple subscription plans with varying features and limits. Pricing tiers are based on the number of billable clients, starting from a Lite plan for up to 5 billable clients to higher-tier plans with more extensive features for larger businesses.

User Feedback

Users appreciate FreshBooks for its user-friendly interface, intuitive design, and excellent customer support. The ease of creating professional-looking invoices and managing finances without complex accounting knowledge is often highlighted. However, some users might find the higher-tier plans relatively costly compared to other alternatives.

#4 Zoho Invoice

Zoho Invoice is part of Zoho Corporation’s suite of business applications known for their versatility and user-friendly interfaces. It’s a cloud-based invoicing software tailored for small businesses, freelancers, and consultants, offering a range of features to streamline invoicing processes.

Key Features

- Invoice Creation and Customization: Provides customizable templates to create professional invoices with branding elements such as logos, colors, and fonts. Allows for recurring invoices and automatic payment reminders.

- Expense Management: Enables you to track expenses, attach receipts, and categorize expenses to be directly billed to clients.

- Time Tracking and Project Management: Offers time tracking tools to log billable hours for projects or client work, which can be directly invoiced.

- Online Payment Integration: Integrates with various payment gateways, allowing clients to pay invoices online via credit cards, PayPal, or other payment methods.

- Estimates and Proposals: Facilitates the creation of estimates and proposals that can be easily converted into invoices.

- Client Portal: Provides a client portal where clients can view invoices, make payments, and communicate regarding billing matters.

- Reporting and Analytics: Generates reports on payments, outstanding invoices, expenses, and other financial data for better insights and decision-making.

- Integration and Customization: Integrates with various Zoho and third-party applications, offering a comprehensive business ecosystem. Allows for customization through APIs and add-ons for enhanced functionalities.

Pricing

If you need the best free invoicing software for small business you can try on this. Zoho Invoice offers multiple pricing plans, including a free plan with limited features and higher-tier plans with more advanced functionalities. The pricing is tiered based on the number of clients and features required, making it scalable for businesses of different sizes.

User Feedback

Customers appreciate Zoho Invoice for its user-friendly interface, customization options, and comprehensive invoicing features. The integration with other Zoho applications and the ability to handle multiple currencies and tax systems is often praised. However, some users may find the learning curve for more advanced features a bit steep.

#5 Xero

Xero is a cloud-based accounting software designed for small and medium-sized businesses. It’s known for its robust accounting features, ease of use, and scalability, making it popular among businesses looking for comprehensive financial management solutions.

Key Features

- Invoicing and Billing: Offers customizable invoice templates with branding options like logos and colors. Supports recurring invoices and automatic payment reminders to streamline billing processes.

- Expense Tracking and Management: Allows users to track and categorize expenses, attach receipts, and reconcile bank transactions.

- Bank Reconciliation: Connects with bank accounts, automating bank reconciliation and ensuring accurate financial records.

- Inventory Management: Provides basic inventory tracking functionalities, allowing businesses to manage stock levels and track inventory value.

- Financial Reporting: Generates a variety of reports like profit and loss, balance sheet, cash flow, and more, offering detailed insights into financial health.

- Payroll Management: Offers payroll features (depending on the subscription) for managing employee pay, taxes, and compliance.

- Integration and Add-Ons: Integrates with a wide range of third-party apps and services, enhancing its functionality and adaptability. Allows for additional features through the Xero marketplace’s add-ons and integrations.

- Multi-Currency Support: Enables businesses to manage transactions in multiple currencies, facilitating global operations.

Pricing

Xero offers various pricing plans tailored to different business needs. Pricing is based on the number of invoices, bills, and bank transactions processed per month, with scalable plans suitable for small businesses and growing enterprises.

User Feedback

Xero is one of the best accounting and invoicing software for small businesses that comes with comprehensive accounting features, user-friendly interface, and excellent customer support. The ability to collaborate with accountants or bookkeepers in real-time and the accessibility of financial data from anywhere is often praised. However, some users might find the pricing slightly higher compared to other alternatives.

#6 Wave

Wave is a free, cloud-based accounting software that offers a range of financial management tools primarily tailored for small businesses, freelancers, and entrepreneurs. It’s known for its user-friendly interface, accessibility, and comprehensive features that cover invoicing, accounting, and more.

Key Features

- Invoicing and Billing: Provides customizable invoice templates with the ability to add logos and personalize invoices. Supports recurring invoices and automatic payment reminders for efficient billing processes.

- Expense Tracking and Management: Allows you to track expenses, upload receipts, and categorize expenses for accurate record-keeping.

- Bank Reconciliation: Seamlessly connects to bank accounts to automate bank reconciliation, ensuring accuracy in financial records.

- Accounting and Reporting: Offers essential accounting functionalities like profit and loss statements, balance sheets, and cash flow reports. Generates insightful financial reports to aid in decision-making.

- Payroll (in select regions): Provides payroll features (in certain regions) for managing employee payments and tax filings.

- Receipt Scanning: Offers a mobile app with receipt scanning capabilities for easy expense tracking on-the-go.

- Integration and Add-Ons: Integrates with some third-party apps and services, although the options are more limited compared to other accounting software.

- Multi-Currency Support: Allows businesses to manage transactions in multiple currencies, facilitating international operations.

Pricing

Wave is known for its free accounting software, which includes core functionalities like invoicing, expense tracking, and basic accounting features. Additional paid services, like payroll and payment processing, are available with fees based on usage.

User Feedback

You’ll appreciate Wave for its simplicity, especially for small businesses and freelancers. The availability of core accounting features for free is a significant advantage. The user-friendly interface, invoicing capabilities, and basic accounting functionalities are often praised. However, some users might find the limited integration options and lack of certain advanced features compared to paid accounting software.

#7 Invoicely

Invoicely is a cloud-based invoicing and billing software designed for freelancers, small businesses, and entrepreneurs. It provides a platform to create, manage, and send invoices, along with several other financial management features.

Key Features

- Invoicing and Billing: Offers customizable invoice templates that allow users to add their branding elements. It supports recurring invoices, multiple currencies, and various payment methods for client convenience.

- Expense Tracking: Enables users to track expenses, attach receipts, and categorize expenses for efficient record-keeping.

- Time Tracking: Provides time tracking tools to log billable hours for projects or client work, which can be directly invoiced.

- Estimates and Quotes: Allows for the creation of estimates and quotes that can be easily converted into invoices.

- Client Portal: Offers a client portal where clients can view invoices, make payments, and communicate regarding billing matters.

- Reporting and Analytics: Generates reports on invoice statuses, expenses, and payments, providing insights into business finances.

- Integration and Customization: Integrates with various payment gateways for online payments and integrates with some third-party applications for enhanced functionality. Allows some level of customization for tailored invoice designs.

- Multi-Currency Support: Supports transactions in multiple currencies, facilitating business operations across borders.

Pricing

Invoicely offers multiple subscription plans, including a free plan with limited features and higher-tier plans with more functionalities.

The pricing tiers are based on the number of clients and features required, catering to businesses of varying sizes.

User Feedback

Customers appreciate Invoicely for its ease of use, customizable invoicing, and the ability to handle multiple currencies. The availability of a free plan and the user-friendly interface are often praised. However, some users might find the available integrations limited compared to other invoicing tools.

#8 Sage

Sage is another comprehensive accounting software known for serving a wide range of businesses, from small enterprises to larger corporations. It provides a suite of financial management tools designed to streamline accounting, invoicing, payroll, and more.

Key Features

- Invoicing and Billing: Offers customizable invoice templates for professional-looking invoices with branding elements. Supports recurring invoices, automatic payment reminders, and multiple payment options.

- Expense Management: You can track and categorize expenses, link them to projects or clients, and streamline expense reporting.

- Bank Reconciliation: Automates bank reconciliation by connecting to bank accounts and ensuring accuracy in financial records.

- Accounting and Reporting: Provides comprehensive accounting features such as balance sheets, profit and loss statements, cash flow reports, and more. Generates detailed financial reports to aid in decision-making and financial analysis.

- Payroll Management: Offers payroll functionality (depending on the subscription) for managing employee pay, taxes, and compliance.

- Inventory Management: Provides advanced inventory tracking capabilities for businesses managing stock and sales.

- Integration and Add-Ons: Integrates with various third-party apps and services, offering a wide range of add-ons to extend functionality. Offers customization through APIs and add-ons for tailored solutions.

- Multi-Currency Support: Allows businesses to manage transactions in multiple currencies, facilitating global operations.

Pricing

Sage offers various pricing plans with different tiers, catering to businesses of varying sizes and needs.

The pricing structure is based on features required, number of users, and scalability, with options for both small businesses and larger enterprises.

User Feedback

The ability to handle complex accounting needs, integrated payroll, and extensive reporting capabilities are often praised. However, some users might find the learning curve steep for new users or smaller businesses, and the pricing might be higher compared to other alternatives.

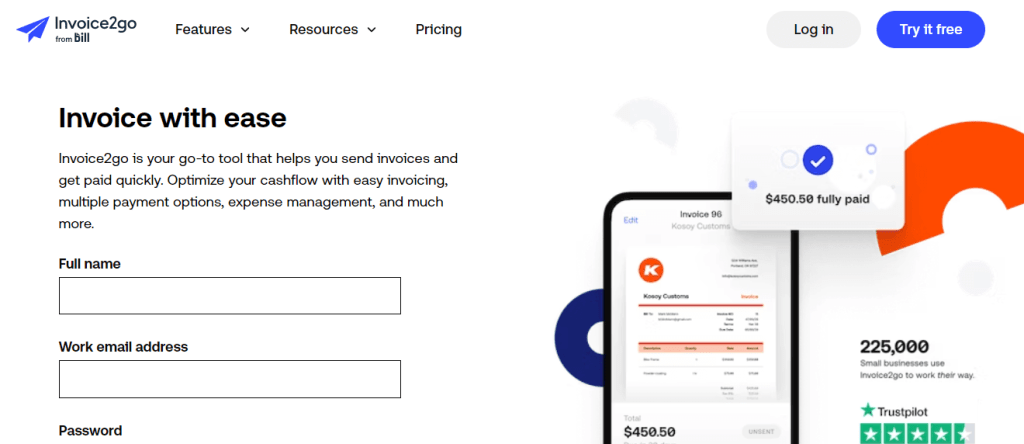

#9 Invoice2go

Invoice2go is a cloud-based invoicing and billing software designed primarily for small businesses, freelancers, and sole proprietors. It focuses on providing a user-friendly platform to create, manage, and send invoices, along with additional tools for expense tracking and business management.

Key Features

- Invoicing and Billing: Offers customizable invoice templates with branding elements like logos and colors. It supports recurring invoices, automatic payment reminders, and multiple payment options for client convenience.

- Expense Tracking: Enables users to track expenses, attach receipts, and categorize expenses for efficient record-keeping.

- Estimates and Quotes: Provides tools to create estimates and quotes that can be easily converted into invoices.

- Client Management: You can manage client information, contacts, and communication within the platform.

- Time Tracking (in select plans): Offers time tracking features to log billable hours and associate them with specific projects or clients.

- Reporting and Insights: Generates reports on invoice statuses, payments, and expenses, providing insights into business finances.

- Integration and Customization: Integrates with various payment gateways for online payments and connects with other business tools to extend functionality. Offers some level of customization for personalized invoice designs.

- Multi-Currency Support: Supports transactions in multiple currencies, enabling businesses to operate globally.

Pricing

Invoice2go offers multiple subscription plans with varying features and limits. The pricing structure is based on the number of invoices, clients, and additional functionalities required, catering to businesses of different sizes.

User Feedback

Undoubtedly, you’ll appreciate Invoice2go for its user-friendly interface, customizable invoicing, and convenience in managing invoices and expenses on-the-go. The availability of multiple currency support and mobile app functionality is often praised. However, some users might find the pricing relatively higher compared to similar invoicing tools, especially for certain advanced features.

Conclusion

Selecting the best invoicing software for small business is akin to finding the right cog for your business engine. software options tailored for small businesses. Each of these tools brings a unique blend of features, pricing structures, and user experiences to the table. From the robust functionalities of Xero to the intuitive interface of Invoice2go and the seamless integrations offered by HubSpot, the spectrum of choices caters to a wide array of business needs.

In the dynamic landscape of business, this journey doesn’t conclude with this comparison. It’s an ongoing exploration, an ever-evolving quest to adapt, refine, and optimize systems. Each business’s unique demands and aspirations will continue to shape their software choices.

So, armed with insights, considerations, and a better understanding of these 10 invoicing champions, businesses are poised to make the informed choice that aligns perfectly with their ambitions. It’s not just about invoicing; it’s about nurturing a foundation for seamless financial management, empowering businesses to thrive.

As the digital landscape evolves, the quest for the perfect invoicing software will persist to guide businesses towards greater efficiency, profitability, and success.

A.I Create & Sell Unlimited Audiobooks to 2.3 Million Users – https://ext-opp.com/ECCO

Thanks for the write-up. My spouse and i have always noticed that many people are desperate to lose weight because they wish to look slim in addition to looking attractive. On the other hand, they do not usually realize that there are more benefits for losing weight additionally. Doctors insist that over weight people experience a variety of illnesses that can be instantly attributed to their own excess weight. The good thing is that people that are overweight along with suffering from different diseases are able to reduce the severity of their illnesses by simply losing weight. It is possible to see a gradual but notable improvement in health when even a negligible amount of weight-loss is accomplished.

Create Stunning Ebooks In 60 Seconds – https://ext-opp.com/AIEbookPal

Elevate Learning Adventures with The Story Shack!

A library of 200+ high-quality books tailored to the school curriculum.

StoryShack’s Build a Book bundle features word searches, quizzes, creative coloring pages, high-quality images, and top SEO keywords.

StoryShack’s StoryCraft Pro bundle includes the “Melody Minds Library” with 350+ music tracks and “AnimateMasters Pro,” offering 30+ categories of animations.

And as if that’s not enough, here are the MEGA BONUSES:

✔ 100+ Mega Mazes Pack

✔ 100+ Sudoku Elements Pack

✔ 100+ Comic Book Template Pack

✔ 100+ Handwriting Practice Template Pack

✔ 100+ Kids Story Book Templates

✔ Canva Book Templates

✔ Additional beautiful content like journal prompts

✔ INCLUDED: The Ultimate Workbook

Click https://ext-opp.com/StoryShack to explore The Story Shack e-Learning Collection and seize the opportunity for multiplied income!

Thanks for revealing your ideas. I’d also like to mention that video games have been ever before evolving. Modern tools and innovations have served create sensible and interactive games. All these entertainment video games were not that sensible when the real concept was first of all being attempted. Just like other kinds of know-how, video games too have had to develop via many many years. This is testimony for the fast development of video games.

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

What i do not understood is in truth how you are not actually a lot more smartlyliked than you may be now You are very intelligent You realize therefore significantly in the case of this topic produced me individually imagine it from numerous numerous angles Its like men and women dont seem to be fascinated until it is one thing to do with Woman gaga Your own stuffs nice All the time care for it up

I抦 no longer certain where you are getting your information, however good topic. I must spend a while finding out much more or understanding more. Thanks for excellent information I used to be looking for this information for my mission.

Thanks for sharing your ideas on this blog. Also, a fantasy regarding the lenders intentions whenever talking about home foreclosure is that the traditional bank will not take my repayments. There is a certain quantity of time in which the bank will require payments occasionally. If you are also deep within the hole, they’re going to commonly require that you pay the actual payment fully. However, i am not saying that they will have any sort of installments at all. In case you and the lender can manage to work anything out, a foreclosure method may cease. However, in case you continue to miss payments beneath new strategy, the property foreclosure process can pick up where it was left off.

What i don’t realize is in truth how you are no longer really a lot more smartly-favored than you may be now. You’re very intelligent. You already know therefore considerably relating to this matter, made me individually believe it from numerous numerous angles. Its like men and women don’t seem to be fascinated unless it抯 one thing to accomplish with Lady gaga! Your personal stuffs great. Always care for it up!

A person essentially help to make seriously articles I would state. This is the first time I frequented your website page and thus far? I amazed with the research you made to make this particular publish incredible. Fantastic job!

Excellent weblog here! Also your web site rather a lot up fast! What host are you using? Can I get your associate hyperlink in your host? I want my website loaded up as quickly as yours lol

You made some clear points there. I did a search on the subject and found most persons will consent with your site.

Great article! I really appreciate the clear and detailed insights you’ve provided on this topic. It’s always refreshing to read content that breaks things down so well, making it easy for readers to grasp even complex ideas. I also found the practical tips you’ve shared to be very helpful. Looking forward to more informative posts like this! Keep up the good work! YouTube Downloader Online

п»їbest mexican online pharmacies: п»їbest mexican online pharmacies – mexican mail order pharmacies

https://indianpharmacy.company/# indianpharmacy com

access pharmacy viagra: acyclovir pharmacy – best online pharmacy ambien

top 10 pharmacies in india: indian pharmacy online – online pharmacy india

zyprexa prices pharmacy Forzest or buy online pharmacy

https://maps.google.cv/url?q=https://pharmbig24.com cialis super active online pharmacy

[url=https://alt1.toolbarqueries.google.co.ck/url?q=https://pharmbig24.com]humana pharmacy otc order online[/url] viagra prices by pharmacy and [url=http://bbs.all4seiya.net/home.php?mod=space&uid=986362]montelukast online pharmacy[/url] viagra cost pharmacy

world pharmacy india: indian pharmacy paypal – indian pharmacy online

http://mexicopharmacy.cheap/# best online pharmacies in mexico

https://indianpharmacy.company/# indian pharmacy

mexican pharmacy prednisone: best australian online pharmacy – cialis pharmacy prices

best online pharmacy india: world pharmacy india – buy medicines online in india

sporanox online pharmacy [url=http://pharmbig24.com/#]dostinex online pharmacy[/url] topamax online pharmacy

medication from mexico pharmacy mexican mail order pharmacies or mexican border pharmacies shipping to usa

http://images.google.com.bn/url?q=http://mexicopharmacy.cheap mexican drugstore online

[url=http://www.hamajim.com/mt/mt4i.cgi?id=4&mode=redirect&no=44&ref_eid=1450&url=http://mexicopharmacy.cheap]pharmacies in mexico that ship to usa[/url] mexico pharmacies prescription drugs and [url=http://bocauvietnam.com/member.php?1523429-akpvbmnzpo]mexican mail order pharmacies[/url] mexican rx online

crestor pharmacy card: online pharmacy china – synthroid pharmacy price

https://pharmbig24.com/# world pharmacy india

purple pharmacy mexico price list mexico drug stores pharmacies or medication from mexico pharmacy

https://www.google.ht/url?q=https://mexicopharmacy.cheap mexico drug stores pharmacies

[url=https://maps.google.bf/url?q=https://mexicopharmacy.cheap]purple pharmacy mexico price list[/url] buying prescription drugs in mexico online and [url=https://98e.fun/space-uid-8793917.html]mexico pharmacies prescription drugs[/url] best online pharmacies in mexico

buying prescription drugs in mexico: pharmacies in mexico that ship to usa – reputable mexican pharmacies online

best online pharmacy india [url=http://indianpharmacy.company/#]Online medicine home delivery[/url] best india pharmacy

top online pharmacy india: best india pharmacy – indian pharmacy paypal

https://indianpharmacy.company/# india pharmacy

estradiol patch online pharmacy: strattera indian pharmacy – the people’s pharmacy wellbutrin

https://mexicopharmacy.cheap/# mexican drugstore online

Aebgkeymn buy ultram from trusted pharmacy or lipitor 4 copay participating pharmacy

https://clients1.google.cv/url?q=https://pharmbig24.com advair pharmacy coupons

[url=https://www.google.bi/url?q=https://pharmbig24.com]prescription discount[/url] pharmacy rx coupons and [url=https://www.xiaoditech.com/bbs/home.php?mod=space&uid=1872368]northwest pharmacy[/url] pharmacy store fixtures and design

buying prescription drugs in mexico online: reputable mexican pharmacies online – buying prescription drugs in mexico online

isotretinoin indian pharmacy [url=https://pharmbig24.online/#]singulair pharmacy prices[/url] online pharmacy drug store

best online pharmacies in mexico mexican rx online or mexico pharmacies prescription drugs

https://www.florbalchomutov.cz/media_show.asp?type=1&id=17&url_back=https://mexicopharmacy.cheap purple pharmacy mexico price list

[url=https://www.hobowars.com/game/linker.php?url=https://mexicopharmacy.cheap]pharmacies in mexico that ship to usa[/url] mexican drugstore online and [url=https://slovakia-forex.com/members/279029-jkzuhomhwe]buying prescription drugs in mexico[/url] mexico drug stores pharmacies

buying prescription drugs in mexico online: mexican border pharmacies shipping to usa – mexican drugstore online

uk online pharmacy international delivery: advair online pharmacy – pharmacy rx one coupons

https://mexicopharmacy.cheap/# medication from mexico pharmacy

http://mexicopharmacy.cheap/# purple pharmacy mexico price list

buy propecia pharmacy: Viagra Super Active – bupropion sr pharmacy

world pharmacy india [url=https://indianpharmacy.company/#]Online medicine home delivery[/url] online shopping pharmacy india

medication costs: giant food store pharmacy – how to buy viagra in pharmacy

https://pharmbig24.com/# superdrug pharmacy viagra

reputable mexican pharmacies online pharmacies in mexico that ship to usa or mexican pharmaceuticals online

https://images.google.com.pg/url?q=https://mexicopharmacy.cheap mexico drug stores pharmacies

[url=https://images.google.com.sv/url?sa=t&url=https://mexicopharmacy.cheap]mexican mail order pharmacies[/url] mexico pharmacies prescription drugs and [url=https://dongzong.my/forum/home.php?mod=space&uid=6797]mexican drugstore online[/url] mexican drugstore online

indian pharmacy online: indianpharmacy com – indianpharmacy com

tadalafil generic pharmacy lexapro pharmacy assistance or pharmacy cialis online

https://ipv4.google.com/url?sa=t&url=https://pharmbig24.com propecia in malaysia pharmacy

[url=https://cse.google.gg/url?sa=t&url=https://pharmbig24.com]sildenafil citrate online pharmacy[/url] us pharmacy no prescription and [url=http://lsdsng.com/user/585610]oxycontin online pharmacy[/url] skip’s pharmacy low dose naltrexone

mexico pharmacies prescription drugs: best online pharmacies in mexico – mexico drug stores pharmacies

https://mexicopharmacy.cheap/# medication from mexico pharmacy

cleocin online pharmacy [url=http://pharmbig24.com/#]best online thai pharmacy[/url] super pharmacy

you are truly a just right webmaster The site loading speed is incredible It kind of feels that youre doing any distinctive trick In addition The contents are masterwork you have done a great activity in this matter

pharmacies in mexico that ship to usa medication from mexico pharmacy or pharmacies in mexico that ship to usa

http://www.jschell.de/link.php?url=mexicopharmacy.cheap&goto=google_news mexican mail order pharmacies

[url=https://weburg.net/redirect?fromru=1&url=mexicopharmacy.cheap/]п»їbest mexican online pharmacies[/url] buying prescription drugs in mexico and [url=http://www.0551gay.com/space-uid-307737.html]buying prescription drugs in mexico[/url] best online pharmacies in mexico

pharmacy online tadalafil: viagra bangkok pharmacy – trust pharmacy viagra

http://indianpharmacy.company/# reputable indian pharmacies

best online pharmacy india: world pharmacy india – mail order pharmacy india

clindamycin uk pharmacy [url=http://pharmbig24.com/#]meijer pharmacy lipitor[/url] quality rx pharmacy

inducible clindamycin resistance in staphylococcus aureus isolated from nursing and pharmacy students: viagra in boots pharmacy – oxymorphone online pharmacy

https://mexicopharmacy.cheap/# purple pharmacy mexico price list

pharmacies in mexico that ship to usa: reputable mexican pharmacies online – mexican border pharmacies shipping to usa

http://mexicopharmacy.cheap/# buying from online mexican pharmacy

buy prescription drugs from india: indianpharmacy com – indian pharmacy paypal

mexican drugstore online [url=https://mexicopharmacy.cheap/#]mexican border pharmacies shipping to usa[/url] mexican mail order pharmacies

online pharmacy atenolol viagra generic pharmacy or pharmacy viagra generic

https://maps.google.lk/url?q=https://pharmbig24.com brand viagra

[url=https://forum.lephoceen.fr/proxy.php?link=https://pharmbig24.com:::]Trecator SC[/url] lamisil pharmacy uk and [url=https://bbsdump.com/home.php?mod=space&uid=7862]pharmacy rx one viagra[/url] mexican pharmacy valtrex

mexican mail order pharmacies buying prescription drugs in mexico online or mexican border pharmacies shipping to usa

http://www.beigebraunapartment.de/url?q=https://mexicopharmacy.cheap:: medicine in mexico pharmacies

[url=https://image.google.td/url?q=https://mexicopharmacy.cheap]mexico drug stores pharmacies[/url] medication from mexico pharmacy and [url=http://hl0803.com/home.php?mod=space&uid=155298]mexican drugstore online[/url] mexico drug stores pharmacies

pharmacy store fixtures: viagra pharmacy reviews – pharmacy world rx

http://pharmbig24.com/# pharmacy course online

wich store or pharmacy sales hgh: zyprexa pharmacy – Aebgstymn

http://mexicopharmacy.cheap/# mexico drug stores pharmacies

purple pharmacy mexico price list medicine in mexico pharmacies or mexico pharmacies prescription drugs

https://www.google.tt/url?q=https://mexicopharmacy.cheap mexico drug stores pharmacies

[url=http://pixelpiraten.org/url?q=http://mexicopharmacy.cheap]mexico drug stores pharmacies[/url] mexico drug stores pharmacies and [url=http://talk.dofun.cc/home.php?mod=space&uid=1643433]purple pharmacy mexico price list[/url] mexico drug stores pharmacies

india online pharmacy [url=https://indianpharmacy.company/#]buy medicines online in india[/url] pharmacy website india

india online pharmacy: online shopping pharmacy india – indian pharmacy paypal

http://indianpharmacy.company/# india pharmacy

buying from online mexican pharmacy: reputable mexican pharmacies online – mexican mail order pharmacies

http://indianpharmacy.company/# indianpharmacy com

colchicine online pharmacy Finax or vermox online pharmacy

https://maps.google.bs/url?sa=t&url=https://pharmbig24.com rx pharmacy viagra

[url=https://maps.google.com.bd/url?sa=t&url=http://pharmbig24.com]plavix online pharmacy[/url] lipitor 4 copay card pharmacy and [url=http://wuyuebanzou.com/home.php?mod=space&uid=1048733]percocet mexico pharmacy[/url] prescription drug cost

mexican pharmaceuticals online buying prescription drugs in mexico or medicine in mexico pharmacies

https://www.ocmdhotels.com/?URL=https://mexicopharmacy.cheap buying from online mexican pharmacy

[url=https://www.google.sc/url?q=https://mexicopharmacy.cheap]best online pharmacies in mexico[/url] buying from online mexican pharmacy and [url=http://mi.minfish.com/home.php?mod=space&uid=1150650]mexican drugstore online[/url] buying prescription drugs in mexico online

pharmacy website india: online pharmacy india – india pharmacy

http://pharmbig24.com/# drug price

top 10 online pharmacy in india [url=http://indianpharmacy.company/#]buy prescription drugs from india[/url] top online pharmacy india

mexican online pharmacies prescription drugs: purple pharmacy mexico price list – purple pharmacy mexico price list

Steel-Reinforced HDPE Pipes : These pipes combine the strength of steel with the flexibility of HDPE, ideal for heavy-duty applications. ElitePipe Factory in Iraq excels in producing steel-reinforced HDPE pipes.

gates of olympus demo turkce oyna: gates of olympus demo – gates of olympus demo turkce oyna

starzbet guvenilir mi [url=http://starzbet.shop/#]starz bet giris[/url] straz bet

starzbet guncel giris: starzbet – starz bet giris

http://betine.online/# betine guncel giris

http://casibom.auction/# casibom giris

casibom giris: casibom guncel giris – casibom guncel

betine [url=https://betine.online/#]betine guncel[/url] betine giris

starzbet guncel giris [url=https://starzbet.shop/#]starzbet[/url] starzbet guncel giris

gates of olympus demo oyna: gates of olympus giris – gates of olympus giris

http://betine.online/# betine promosyon kodu

casibom 158 giris: casibom giris – casibom

http://casibom.auction/# casibom 158 giris

starzbet guncel giris: starzbet guvenilir mi – starzbet guncel giris

casibom [url=https://casibom.auction/#]casibom 158 giris[/url] casibom guncel

casibom giris: casibom guncel – casibom 158 giris

http://casibom.auction/# casibom 158 giris

starzbet guvenilir mi [url=http://starzbet.shop/#]straz bet[/url] starzbet giris

casibom guncel giris adresi casibom guncel giris or casibom giris

http://henaialbi.net/mt/mt4i.cgi?id=1&mode=redirect&no=258&ref_eid=398&url=https://casibom.auction casibom guncel giris

[url=http://www.google.tn/url?q=https://casibom.auction]casibom guncel giris[/url] casibom guncel giris adresi and [url=http://xn--0lq70ey8yz1b.com/home.php?mod=space&uid=306878]casibom guncel giris[/url] casibom guncel giris adresi

gates of olympus giris: gates of olympus demo turkce – gates of olympus slot

casibom guncel giris [url=https://casibom.auction/#]casibom 158 giris[/url] casibom guncel giris

https://ventolininhaler.pro/# ventolin uk pharmacy

Buy semaglutide pills rybelsus or rybelsus cost

https://www.google.ms/url?sa=t&url=https://rybelsus.tech rybelsus price

[url=https://www.solutionskills.com/exit.php?title=My20Guforbiddene&url=http://rybelsus.tech]buy semaglutide online[/url] Rybelsus 7mg and [url=http://bbs.zhizhuyx.com/home.php?mod=space&uid=11464987]Semaglutide pharmacy price[/url] rybelsus

buy ventolin pharmacy: Ventolin inhaler best price – online pharmacy ventolin

lasix generic: cheap lasix – lasix 100 mg tablet